By Neil Maycock, CMO and GM Playout

The old broadcast model of widespread content syndication has been turned on its head as the titans of streaming battle to win and retain subscribers. The walls of exclusivity that used to surround flagship sports and a few high-profile series are now extended outwards to a much wider field.

In the digital age, consumers want the best perceived value for money – they also want stuff NOW!, which has led to a new 24/7, 365 days a year culture that is driven by the desire for immediacy and ‘anytime, anywhere’ consumerism.

Nowhere does this “now generation” culture prevail more than in the media and entertainment world. In the past two decades, we have seen the dramatic rise of on-demand content services and major changes in the way consumers want to access content across multiple devices – place and time shifting.

Moreover, the way in which viewers are willing to pay for this content is also evolving.

Traditional TV advertising is still the largest revenue source for content owners and service providers, earning $166bn in 2019. But it is on a downwards trend and continued to decline with a 12% year-over-year fall in 2020, due partly to the impact of COVID-19. Although starting from a lower base, OTT video ad spending is expanding at the fastest rate of any powerful medium and is set to hit $4 billion this year.

On the subscription side, traditional cable and satellite pay-TV revenues have declined by low double-digits since 2017, while OTT subscription revenues are growing – and expected to reach US$133 billion this year.

Although the various analysts differ by a few percentage points – and COVID-19 will shake a few assumptions, it seems likely OTT subscription and ad revenue will ultimately eclipse all other sources of income – with some forecasts suggesting $221bn by 2025.

Going direct

On the production side of the fence, we are seeing content costs increase as new media players enter the bidding for key producers, brands, and sports rights. In response, traditional media is consolidating to secure intellectual property, reduce overhead cost, and pool technology investments. However, further back in the content supply chain, rights owners and content creators are bypassing incumbent distributors and creating direct-to-consumer OTT offerings. Sports TV is a crucial battleground with exemplars like Formula One, MLB and NHL all creating domestic and global offerings that eliminate a layer of distribution and capture a greater share of revenue directly from consumers.

But these pioneers are not alone. Individual and small-scale content creators are increasing, enabled by low entry barriers for semi-professional production and low-cost distribution models that utilize platforms including YouTube, Twitch, and Patreon.

It is a complicated landscape – and a difficult one to navigate for traditional broadcasters that have to fend off rivals from the world of telecommunication that see “content” as a way to create stickier broadband and 4G/5G bundles. Simultaneously, broadcasters are also sparring with internet rivals, with diverse aims such as supporting retail sales via ‘Prime-Style’ subscriptions or tying users into walled garden ecosystems like Apple or Google.

Broadcasters, caught between a rock and a hard place, are trying to attract and retain eyeballs to support advertising revenue and ultimately create innovative, unique content that not only consolidates traditional viewership but engages new audiences. The reality is a market in a state of flux. The winners and losers will play out over the next few years.

“Extra extra!”

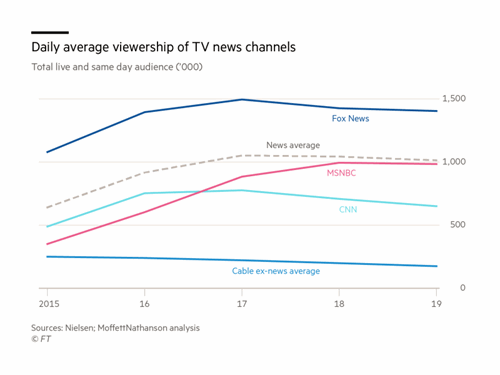

However, several interesting trends are worth examining in further detail. One of the areas where traditional broadcasters have managed to retain a consistent viewership is within the news.

Looking at the three main news networks in the US, the overall data shows a mild decline in viewership over the last three years due to the rise of other news sources such as Facebook, Twitter, and Instagram. What is more interesting is at the local level. The Pew Research Centre for Journalism and Media suggests that local TV news is still more popular than national news networks and the hours-per-day of local TV news consumption has grown by 62% between 2013 and 2018.

Looking at the three main news networks in the US, the overall data shows a mild decline in viewership over the last three years due to the rise of other news sources such as Facebook, Twitter, and Instagram. What is more interesting is at the local level. The Pew Research Centre for Journalism and Media suggests that local TV news is still more popular than national news networks and the hours-per-day of local TV news consumption has grown by 62% between 2013 and 2018.

Although traditional local TV advertising revenues have fallen over the last few years, digital advertising around news content has seen strong double digit growth leading to only a marginal overall shortfall.

The take away from these datapoints suggest an overall positive growth trend for local TV news and an optimistic future where technology and innovative Electronic News Gathering (ENG) methods can help power more news quantity, quality, and diversity – with the internet offering greater reach for localized news while simultaneously reducing costs.

Home game

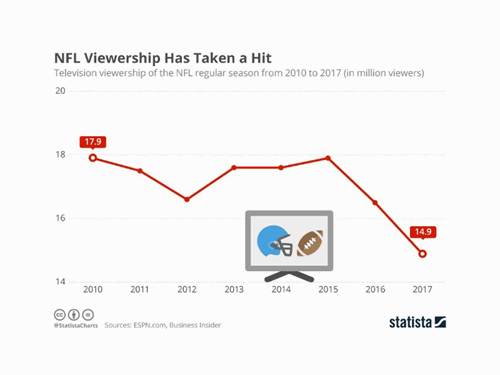

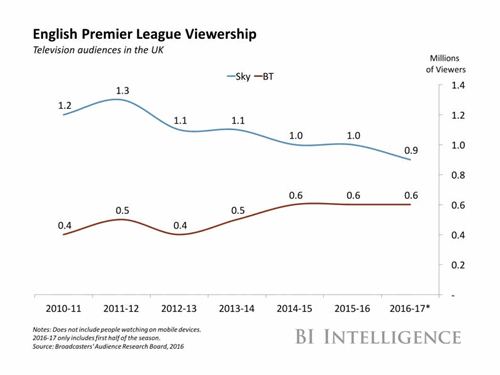

The localization trend also plays into the other big success story for traditional TV – live sports. Although it’s true the world’s two biggest sports leagues, the NFL and English Premier League, have seen a multi-year decline within their home nations, there has been an overall increase in sports broadcast TV viewership across international markets.

For example, the 2019 ICC Cricket World Cup was the most viewed sporting event of that year, with the tournament achieving a cumulative live audience of 1.6 billion viewers. Esports saw around 458.8 million viewers worldwide in 2019, which is likely to be double in 2020 due, in part, to lock-down restrictions.

Sports that were previously too niche for traditional TV – such as MMA, darts, rowing, formula E, and competitive cycling – have found audiences on DTT, cable, and increasingly OTT services where they can support an FTA (free-to-air) model that is backed up by digital advertising. While local sports, right down to a town’s football, cricket, or rugby club, may well tie into the desire for local news delivered via OTT – so long as production costs can be kept low and the production quality can remain acceptable to viewers.

Innovate to compete

These are just two directions from many possibilities and highlight what is so exciting about the current TV landscape. We are at a point when the pervasiveness of the internet revolution has prompted a massive consumer shift that is changing our industry's entire business structure. The plethora of different models is forcing a new level of competitiveness.

Yes, 2020 has been marred by the global pandemic. And its impact will have skewed some of the data points and longer-term trends. However, the status quo between content producers, distributors, and consumers has fundamentally changed. Only innovation and the courage to try different options will offer a successful path moving forward.